sales tax calculator austin texas

The calculator will show you the total sales tax amount as well as the county city and. You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself.

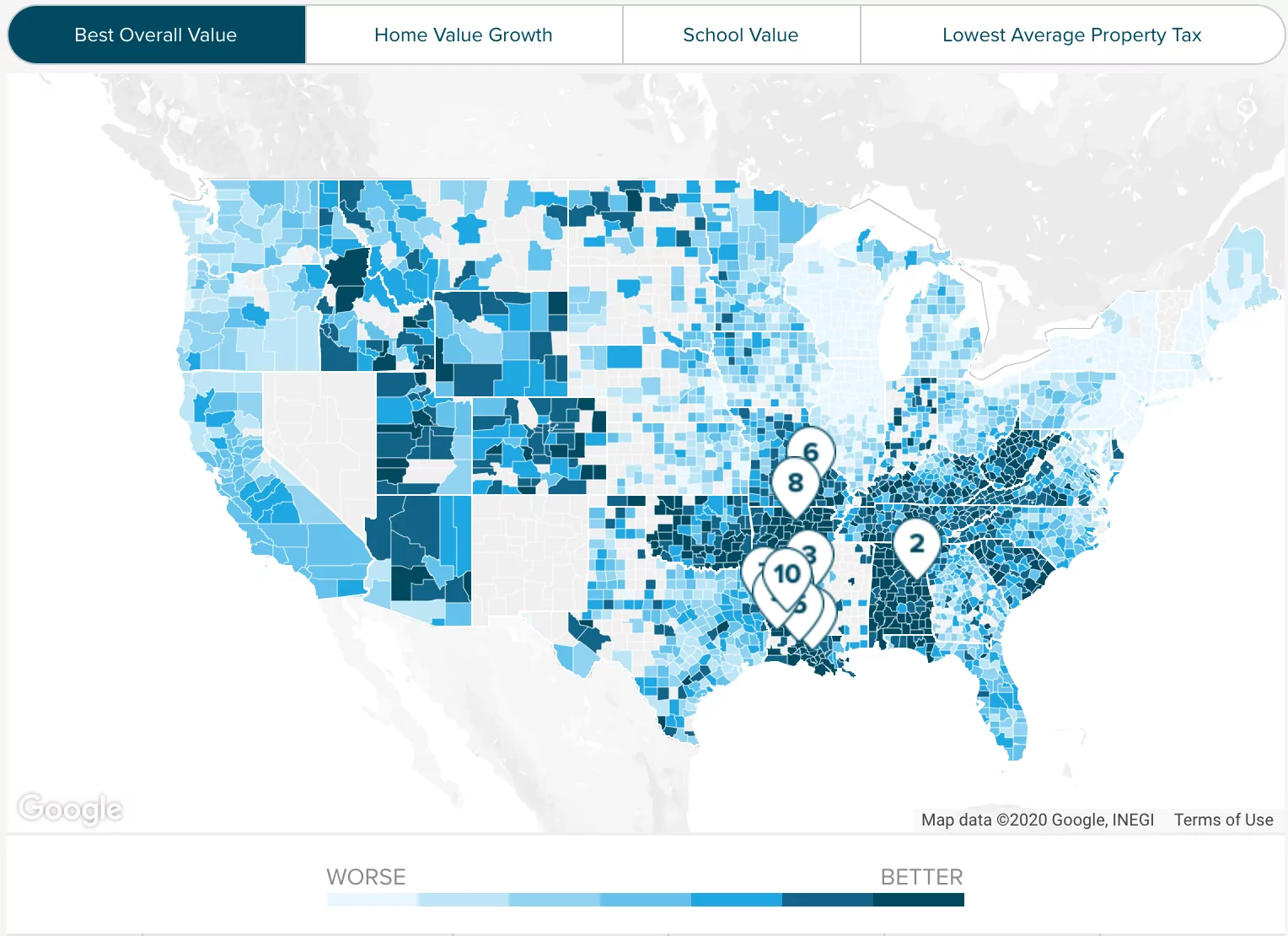

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Ad Automate your sales tax process.

. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. As far as all cities towns and locations go the place with the. Our Prebuilt Connection Allows for Seamless Interaction with Your Existing Software.

Sales tax in Austin Texas is currently 825. Austin collects the maximum legal local sales tax. Maximum Local Sales Tax.

And all states differ in their. Easily manage tax compliance for the most complex states product types and scenarios. Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2.

The most populous location in Austin County Texas is Sealy. List price is 90 and tax percentage is 65. The minimum combined 2022 sales tax rate for Austin County Texas is.

Divide tax percentage by 100. The base state sales tax rate in Texas is 625. Texas State Sales Tax.

The December 2020 total local sales tax rate was also 8250. The Texas sales tax rate is currently. The average cumulative sales tax rate between all of them is 708.

The 825 sales tax rate in Austin consists of 625 Texas state sales tax 1 Austin tax and 1 Special tax. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. What is the sales tax rate in Austin County.

The base sales tax in Texas is 625. Multiply price by decimal. Ad Automate Your Sales Tax Process with Avalaras Sales Tax Automation Software.

Average Local State Sales Tax. This is the total of state and county sales tax rates. The current total local sales tax rate in Austin TX is 8250.

The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. The sales tax rate for Austin was updated for the 2020 tax year this is the current sales tax rate we. Before-tax price sale tax rate and final or after-tax price.

Texas Sales Tax. There is no applicable county. Choose your county city from Texas below for local Sales Tax calculators.

Or use Sales Tax calculator at the front page where you can fill in percentages by yourself. Easily manage tax compliance for the most complex states product types and scenarios. The County sales tax rate is.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. See reviews photos directions phone numbers and more for Sales Tax Calculators locations in Austin TX.

Maximum Possible Sales Tax. 65 100 0065. Austin Sales Tax Rates for 2022.

Austin Texas and San Jose California. US Sales Tax calculator Texas Austin. California are 618 more expensive than Austin Texas.

2022 Cost of Living Calculator for Taxes. 625 percent of sales price minus any trade-in allowance. Ad Automate your sales tax process.

Calculate the proper tax on every transaction. Cost of Living Indexes. The price of the coffee maker is 70 and your state sales tax is 65.

How much is sales tax in Austin in Texas. Find your Texas combined state and. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special.

The minimum combined 2022 sales tax rate for Austin Texas is. Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. Calculate the proper tax on every transaction.

This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 6750. The current total local sales tax rate in Austin County TX is 6750.

Texas Sales Tax Rates By City County 2022

Conroe Proposes Raising Property Tax Rates Ahead Of Next Year S State Mandated Cap Community Impact

How To Calculate Texas Sales Tax

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Register File Taxes Online In Texas

Texas Income Tax Calculator Smartasset

Harris County Tx Property Tax Calculator Smartasset

Why Are Texas Property Taxes So High Home Tax Solutions

Calculation Of Federal Employment Taxes Payroll Services

Llc Tax Calculator Definitive Small Business Tax Estimator

Texas Income Tax Calculator Smartasset

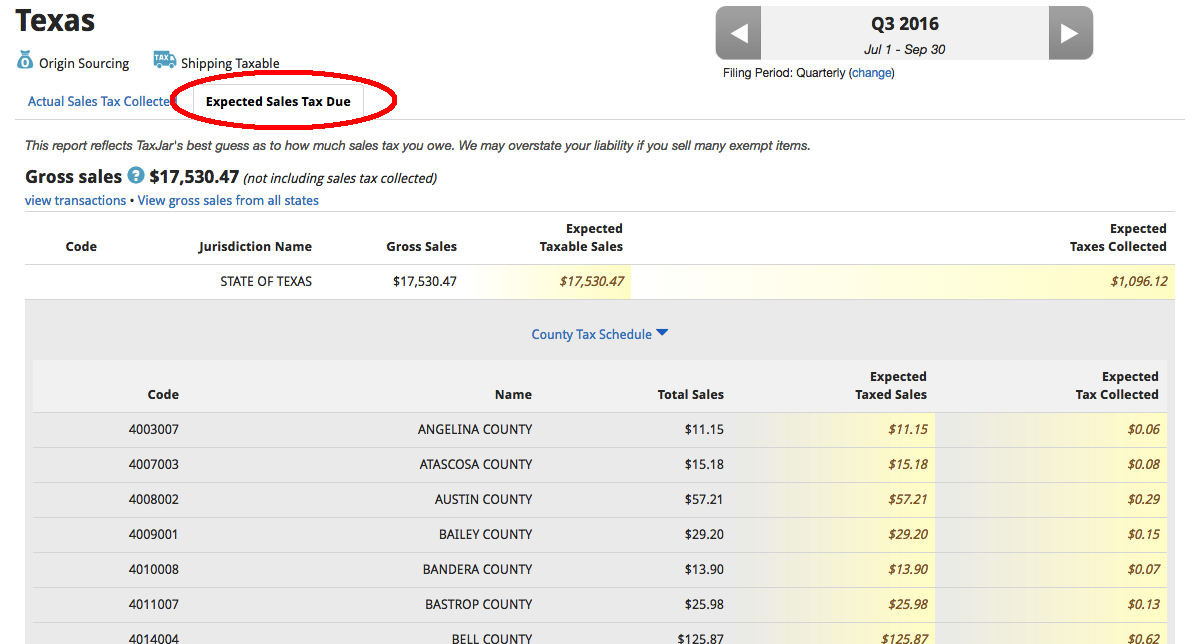

Some Texas Online Sellers Receive Alarming Sales Tax Penalty Notification Taxjar

Texas Sales Tax Guide And Calculator 2022 Taxjar

How To Register File Taxes Online In Texas

Calculation Of Federal Employment Taxes Payroll Services

Sales Tax On Grocery Items Taxjar

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price