child tax credit portal update dependents

The maximum credit for other dependents is 500 and it has the. From what I read the only way to do this is to use the IRSs Child.

FAMILIES in Connecticut can apply for the states child tax credit and possibly receive up to 250 per child.

. File a federal return to claim your child tax credit. Age is determined on December 31 2021. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax.

If your child turns 18 this year then they are not eligible for the monthly Child Tax Credit. Visit ChildTaxCreditgov for details. The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income.

The monthly child tax credit payments will begin on July 15 Credit. Eligible families receive 300 monthly for each child under 6 and 250 per older child. Visit the IRS website to access the Child Tax Credit Update Portal Go to httpswwwirsgovcredits-deductionschild-tax-credit-update-portal.

For tax year 2021 qualifying families claiming the Child Tax Credit will receive. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Click the blue Manage.

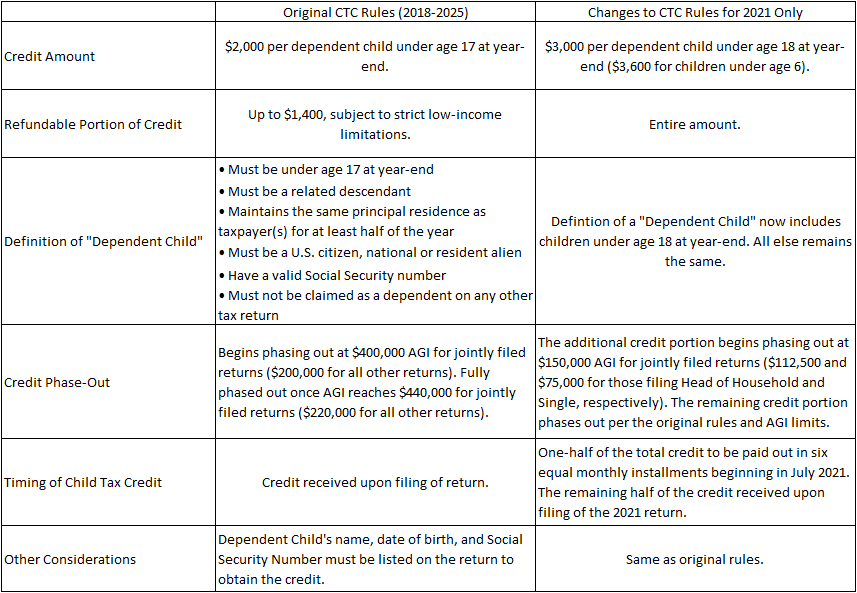

Check Out the Latest Info. Child tax credit portal. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Ad Get Your Maximum Refund Guaranteed Even If Youve Received The Advance Child Tax Credit. Ad Child Tax Credit Portal. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Parents can claim the benefits for up to three children. The IRS will make a one-time payment of 500 for dependents age 18 or fulltime college students up through. This means that instead of receiving monthly payments.

Up to 3000 per qualifying child between the ages of 6 and 17 at the end of 2021 Up to 3600 per qualifying. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit.

That total changes to 3000 for each child ages six through 17. Getty Parents can also receive a 3600 credit for children under six years old. For children under 6 the amount jumped to 3600.

Join The Millions Who File Smarter And Get Your Taxes Done Right Guaranteed. WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Biden has also altered the. Browse Our Collection and Pick the Best Offers. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

W ith just one Child Tax Credit remaining for 2021 United States citizens have until November 29 to make any final changes in their IRS portal relating to their income before. We had our first child at the end of August and would like to claim her and start receiving the monthly tax credit payment. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more.

The Child Tax Credit provides money to support American families. Here is some important information to understand about this years Child Tax Credit. Simple or complex always free.

However the American Rescue Plan did.

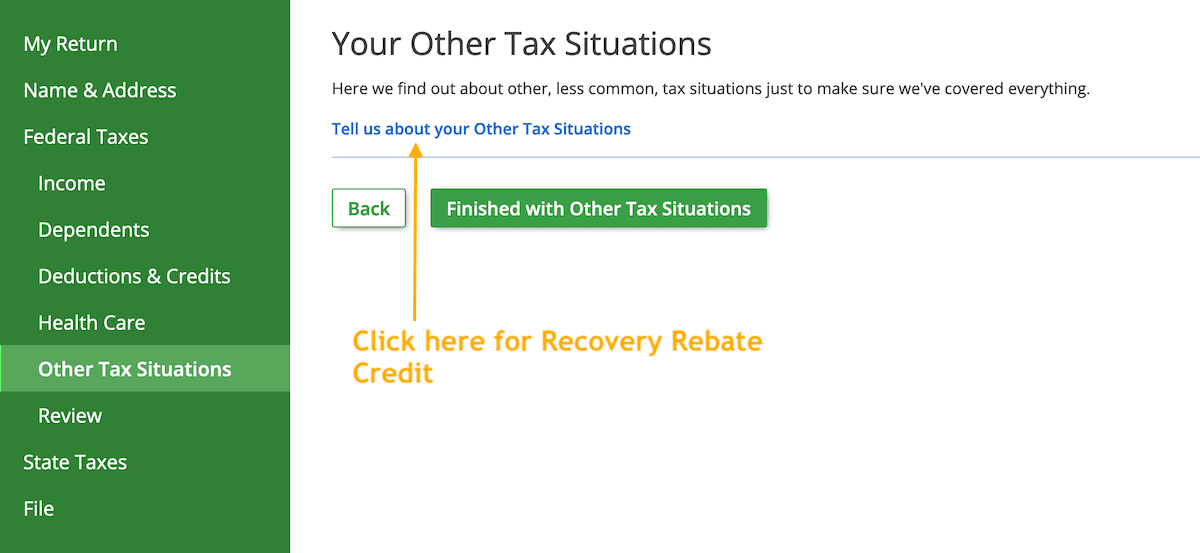

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

2021 Child Tax Credit Steps To Take To Receive Or Manage

2021 Child Tax Credit Explained Storen Financial

Child Tax Credit Changes Weigh The Benefits Vs Impact On Your Tax Liability Grf Cpas Advisors

Here S What You Need To Know About Child Tax Credit Payments The Washington Post

Did Your Advance Child Tax Credit Payment End Or Change Tas

Dependent Children 2021 Tax Credit Jnba Financial Advisors

Tas Tax Tip Ten Things To Know About Advance Child Tax Credit Payments Taxpayer Advocate Service

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Arpa Expands Tax Credits For Families

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

2021 Child Tax Credit Explained Storen Financial

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)